One of the most significant decisions that anyone can make in their life is purchasing a home. If you are a first-time homebuyer, you may be wondering, “I want to buy a house; where do I start?” Our goal is to make the home buying process as seamless and stress-free as possible. That is why we created a 2021 guide outlining the home buying process steps to help you get comfortable and familiar with standard terms and milestones.

Summary of the Steps to Buying a Home:

- Check your credit score and get your financials in order

- Review your employment and income

- Review your current debts

- Determine your down payment amount

- Choose a mortgage company

- Get pre-approved

- Find a real estate agent

- Start house hunting and make an offer

- Get a home inspection

- Order a home appraisal

- Receive a loan decision

- Close on your new home

1.) Check your credit score and get your financials in order

The best place to start is to determine if you are in a financial position to take on the responsibility of owning a home. Your credit score sheds light on your ability to handle debts and impacts your mortgage interest rate. Having a higher credit score may make it easier for you to qualify for a loan program and get you access to better rates. Click here to learn more about ways to improve your credit score.

2.) Review your employment and income

Another way to help determine if you are in the proper financial position to buy a home is to review your income and employment status. It is best to buy a home or apartment when you have maintained a regular income for a couple of years, which is especially important for self-employed borrowers, and plan on keeping the job for the foreseeable future. The mortgage underwriter will see if you have a reliable job and consistent monthly income to ensure your ability to repay the loan. If you recently changed jobs, you may need to provide employment and income documentation from your former and current position.

3.) Review your current debts

Even if you may have a steady income, you should review how much debt you have before thinking about getting a mortgage. Having large debts can make it challenging to secure a mortgage, as adding on more debt will increase your debt-to-income ratio. Debt may include car loans, student loans, credit card debt, or medical bills. Try paying off these debts as much as possible before starting the home buying process!

- Keep the 36% rule in mind

The 36% rule is a rule that mortgage companies follow when evaluating your current debt-to-income ratio. This rule states that a homebuyer should not spend more than 36% of their income on debts (this means ALL debt – car, student loans, credit card debt, a mortgage, etc.).

4.) Determine your down payment amount

Before speaking with a mortgage lender, it is crucial to understand how much money you have saved or how much you will need to save for a down payment on a home. Understanding how much you have for a down payment will help you set more realistic expectations before searching for a home.

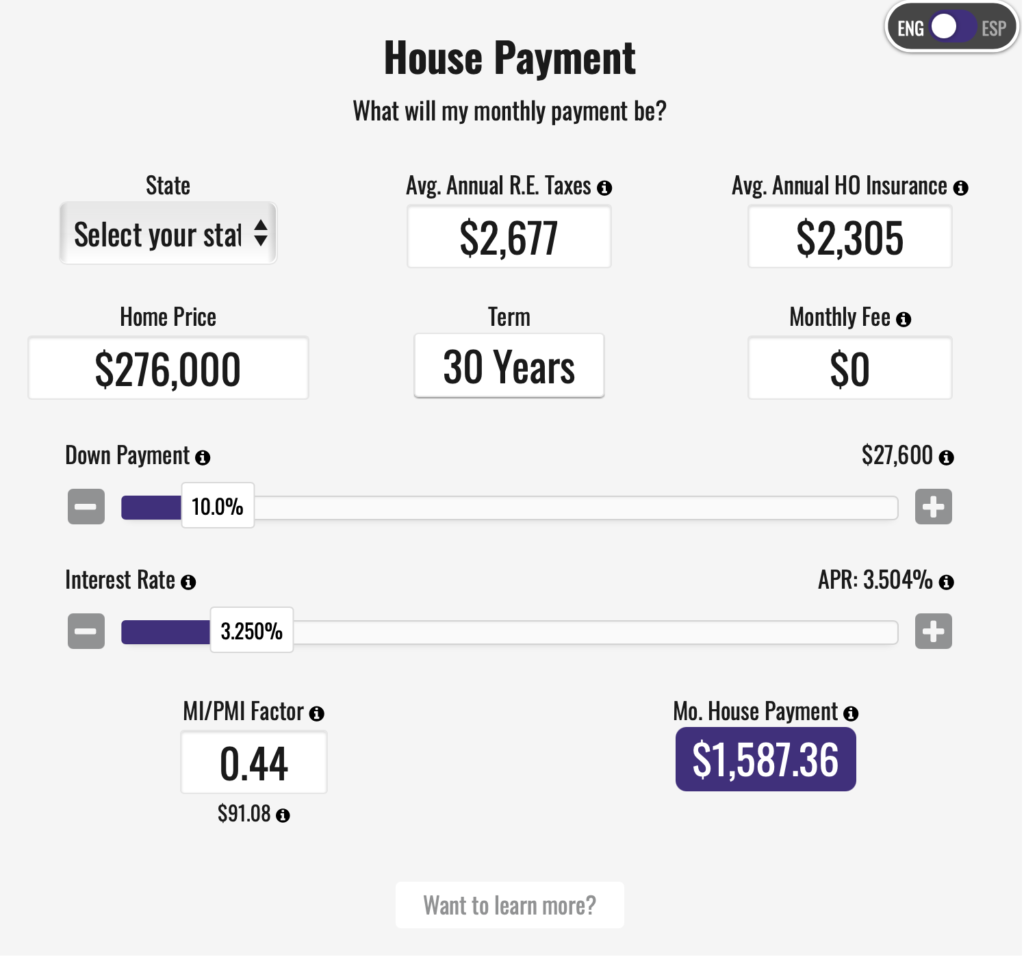

Click the image below to use a mortgage calculator to estimate how much house you can afford by inputting scenarios with different interest rates, purchase prices, and down payment amounts to see how those factors affect your monthly payment. Seeing which estimated payments best fit your current budget may help you get a better idea of how much you may need for a down payment.

5.) Choose a mortgage company

When you feel confident in buying a home, you will need to choose a mortgage company! Just note – selecting a mortgage company is not always about chasing the lowest rate. Many people spend countless hours comparing rate quotes from various companies but often overlook other critical factors to determine a positive mortgage experience. Instead, focus on the combination of the rates quoted, loan programs offered, and service provided.

6.) Get pre-approved

Get pre-approved by applying for a mortgage and submitting your documentation. After submitting your documents, a mortgage specialist will thoroughly review your credit profile to determine your purchasing power and how much mortgage you will qualify for. From there, you will receive an official pre-approval letter!

Remember – this is a critical step in the home buying process. A pre-approval makes you a more competitive buyer and aids in negotiating power when making a purchase offer.

7.) Find a real estate agent

After clearly understanding your budget, you can then find a real estate agent to work with. Ask your friends, family, and colleagues for referrals! GuardHill also works closely with many real estate agents and can refer you to an expert in your area.

Note: some home buyers have an established relationship with a real estate agent before getting pre-approved or even before step 1, which is OK!

8.) Start house hunting and make an offer

Time to start searching for your dream home! It is helpful to create a wants and needs list to narrow down your home search and understand what you are genuinely looking for in a home. This will also give your real estate agent better direction when scheduling showings. If you’re not sure where to start, check out our house hunting tips for first-timers! Your real estate agent will help you determine a wise and fair offer based on recent sales in the neighborhood and the current state of the market when you’re ready to make an offer on a home.

9.) Get a home inspection

Before you finalize the terms of the sale and close on your mortgage, you must schedule a home inspection. This will help you evaluate whether there are any problems the seller needs to fix before you officially move in. If any significant issues arise in the home inspection report, you can discuss your negotiation options with your mortgage specialist and real estate agent.

10.) Order a home appraisal

Mortgage companies require an appraisal to determine the home’s market value and protect you from overpaying for the property. Additionally, this helps ensure that the mortgage company is not lending you more money than the home is worth (also referred to as a loan-to-value ratio).

11.) Receive a loan decision

Once the appraisal and inspection are complete, the mortgage company will provide an underwriting decision. Your loan may be approved, approved with conditions, or denied. You may need to provide additional documentation to show that you qualify for the loan.

12.) Close on your new home

Once your mortgage receives final approval, it is time to schedule your mortgage closing! You will review and sign all necessary documents at the closing to finalize the agreement. Given the current climate today, you may have the option to schedule a virtual or mobile mortgage closing.

After your closing, you will receive the keys to your new home. Congratulations on your homeownership!

If you or someone you know is looking to get started with the home buying process, feel free to contact one of our mortgage specialists. We look forward to helping make your dream home become a reality.