In today’s competitive real estate market, pre-approvals are more crucial than ever. Before you start the home buying process, it’s essential to understand the basics of the mortgage pre-approval process and how it may help you purchase your dream home.

What is a Mortgage Pre-Approval?

A mortgage pre-approval is a written commitment from a mortgage company determining your purchasing power and states how much you can borrow based upon your financial information. Pre-approvals help borrowers establish a budget and allow them to narrow their home search.

What’s the Difference Between a Mortgage Pre-Approval and Pre-Qualification?

A pre-approval is a more in-depth review of your credit profile and is issued after an underwriter reviews your documents. A pre-qualification is a simple, non-binding letter drawn up by a mortgage specialist that provides an estimated or approximate loan amount. A pre-qualification is not an official commitment, whereas a pre-approval is.

How Long Does it take to get Pre-Approved?

GuardHill can offer same-day pre-approvals. However, the timeline may depend on how long it takes you to gather and submit your documents for review. The faster you can provide all the necessary information, the faster the mortgage company can review your credit profile!

How Long is a Mortgage Pre-Approval Good for?

Mortgage pre-approvals are typically good for about 60-90 days. Expiration dates may vary by lender, and it is essential to inquire about the expiration date upon receiving a pre-approval.

Why Do Pre-Approvals Expire?

A pre-approval has a time frame because the mortgage company bases it on your most recent financial information. After 2-3 months, you may have switched jobs, been promoted, or acquired more assets. Thus, the loan amount you qualify for in a few months may be different than what you were initially told.

How Do I Get Pre-Approved?

The first step to getting pre-approved is submitting a mortgage application. From there, you will submit documentation for the mortgage specialist to review. Click here to review the typical documentation required for a mortgage pre-approval.

After providing the proper documentation, the mortgage company will check your credit to understand how well you have handled past debt.

How Much Can I Get Pre-Approved For?

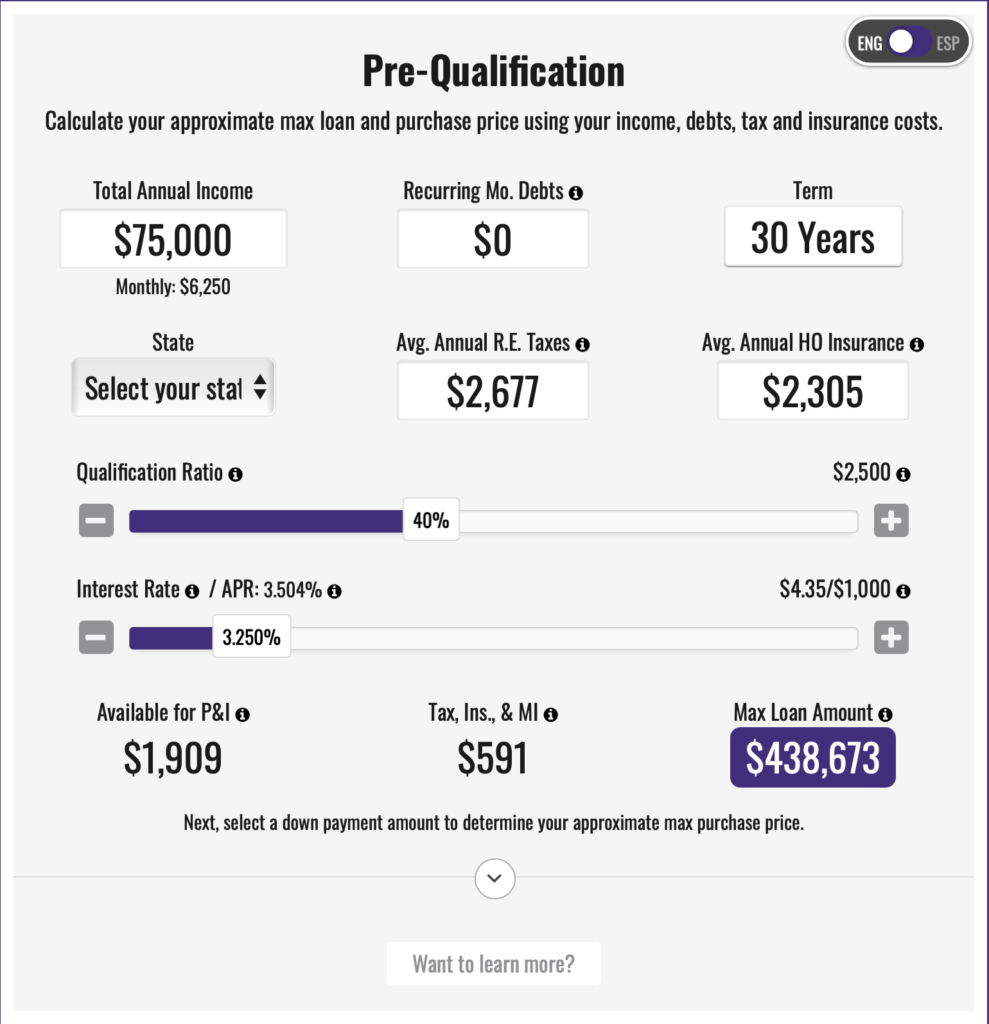

If you are interested in exploring how much house you may be able to afford based on your current income and debts, click the interactive tool below to calculate an approximate loan amount.

Why are Pre-Approvals Important?

A mortgage pre-approval makes you a more competitive buyer, which is becoming increasingly important in today’s real estate market filled with bidding wars. Getting pre-approved shows the real estate agent and seller that you are a serious buyer and may have a better opportunity to secure financing for the home than other buyers.

Use our mortgage amortization calculator to help you visualize which monthly mortgage payments may fit within your desired budget.

What Happens if my Pre-Approval Expires While I am Searching for a Home?

If you are still searching for a property after that 60 or 90 day period (or however long yours is good for), you should get in touch with your mortgage company to get an updated pre-approval letter. You may have to provide updated pay stubs, bank statements, or credit information.

If you or someone you know is interested in getting pre-approved or learning more, contact us today!