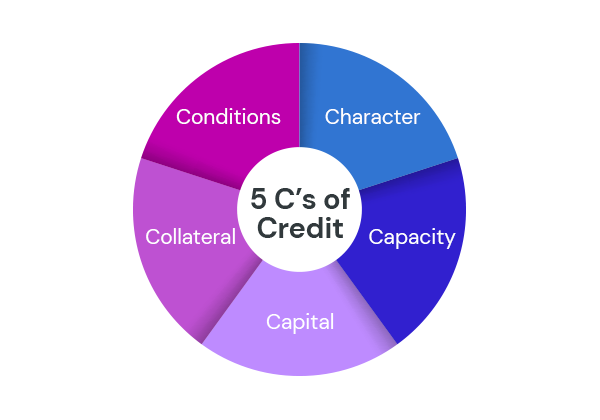

The 5 C’s of credit are a way for financial institutions to evaluate how responsible and trustworthy you are based on your ability to handle and repay debt obligations. This is also referred to as your ‘creditworthiness.’ The 5 C’s include conditions, character, collateral, capital, and capacity.

The Components of the 5 C’s of Credit Explained

Character

Character helps a lender understand if you are a reliable and trustworthy borrower based on your history with other debt obligations. All the information used to analyze your character is presented on your credit report, which outlines your payment history, employment history, and lines of credit.

How to improve: If your credit report showIf your credit report shows some delinquent information, focus on healthy credit building habits. Set up automatic payments to ensure timely monthly payments or don’t apply for new credit often.

Capacity

Capacity measures your ability to repay debt based on your available cash flow. Whether you are self-employed or salaried, the lender will ensure your monthly and annual income surpasses your monthly and yearly debts, also known as your debt-to-income ratio. You should avoid spending more than 43% of your monthly income on monthly debts.

How to improve: If you already have a high debt-to-income ratio, you may have to focus on paying off debt before applying for a mortgage.

Capital

Capital refers to your total investment or down payment amount. Typically, having a higher down payment translates into a lower interest rate, reducing the lender’s associated risk. The average down payment on a house is around 20%; however, GuardHill offers loan programs with more minor down payment requirements.

How to improve: If you don’t have enough money to put down on the house, click here to read about tips on saving for a down payment! Or, you may benefit from a down payment gift.

Collateral

Collateral is personal assets used to guarantee or secure a loan. Assets may be the actual home or other personal assets such as investments. This assures the lender that if you defaulted on your mortgage (stopped making payments), the lender could rely on the secured asset to recoup the losses.

Conditions

Conditions mainly involve external factors such as the current state of the economy and market trends. These factors may affect the lender’s ability to offer specific loan programs or affect the requirements needed to issue a loan approval. Right now, lenders are taking a few extra steps and precautions to verify employment, income, and assets.

How to improve: Make sure you are prepared to answer additional questions about your income, employment, and assets. Some lenders may require other documentation, as well. Click here to review our mortgage documentation checklist to better prepare for your mortgage process!

Why are the 5 C’s of Credit Important?

The 5 C’s paint a better picture of your credit and financial profile and helps the mortgage lender or financial institution determine your loan qualification. This allows the lender to understand if you are a financially responsible borrower. Additionally, reviewing these factors may help you better prepare for the financing process by shedding light on areas that may need improvement, such as making more consistent, timely credit card payments.

Get in touch with one of our mortgage specialists if you have any further credit questions or are ready to get started!