Mortgage rates have remained at historic lows, and may rise, so people may be wondering, “Should I lock in my mortgage rate today?” Mortgage rates fluctuate often, so we recommend locking in that rate if you are quoted a rate with monthly payments that fit within your budget. Use this mortgage amortization calculator to see which monthly payments may be suitable for your budget. If you are considering a mortgage refinance, determine if locking in a lower rate will reduce your monthly mortgage payments have help you realize additional savings.Here are some questions to ask yourself and your lender when thinking about what option is right for you.

What is a Mortgage Rate Lock?

A mortgage rate lock is a guarantee* from a mortgage lender stating that you will receive a certain interest rate for a specific amount of time. A rate lock essentially freezes the interest rate for a specified time and protects the borrower’s interest rate from changing with daily rate movements.

*Rate lock policies may vary by lender

How Long Can You Lock in a Mortgage Rate?

Typically, the mortgage rate lock period is for 30, 45, or 60 days. But, depending on the type of loan program, the rate lock period may extend beyond 60 days.

When Can I Lock in My Rate?

Technically, you can lock your rate any time after you completed the mortgage application. It is important to note that a rate lock is void if any information on the application, such as the appraisal, credit score, or income changes. We often advise our clients to lock in a rate when comfortable with the estimated monthly payments. For a purchase mortgage, it is common to wait until you found a home and have a signed contract before locking a rate.

What Happens if Your Mortgage Rate Lock Expires Before Closing?

IIf the mortgage rate lock expires before your mortgage closing, you may negotiate a rate lock extension or accept the current market rate. If you accept the current market rate, your rate will float and change with daily interest rate movements. A rate lock extension may or may not induce a fee. However, your mortgage company will monitor your rate lock period with the processing time frame to avoid possible expirations or extensions.

What Happens if Rates Rise During the Rate Lock Period?

If rates rise during your lock period, you will be protected from the rate increasing since your rate is “frozen.”

What Happens if You Lock in a Mortgage Rate and the Rate Goes Down During the Lock Period?

If mortgage rates fall during the lock period, your rate will not automatically decrease. However, your loan originator may allow you to take advantage of a lower rate with a “float down” option during your rate lock period.

What is a “Float-Down” Option?

If you and your mortgage company agree to a “float-down” option, then you may be able to lower your rate for a small fee. Since the “float-down” option comes with a fee, your loan originator will advise you on whether the monthly savings associated with a lower rate outweigh the cost to “float-down.”

How to Decide Whether to Lock or Float Your Rate?

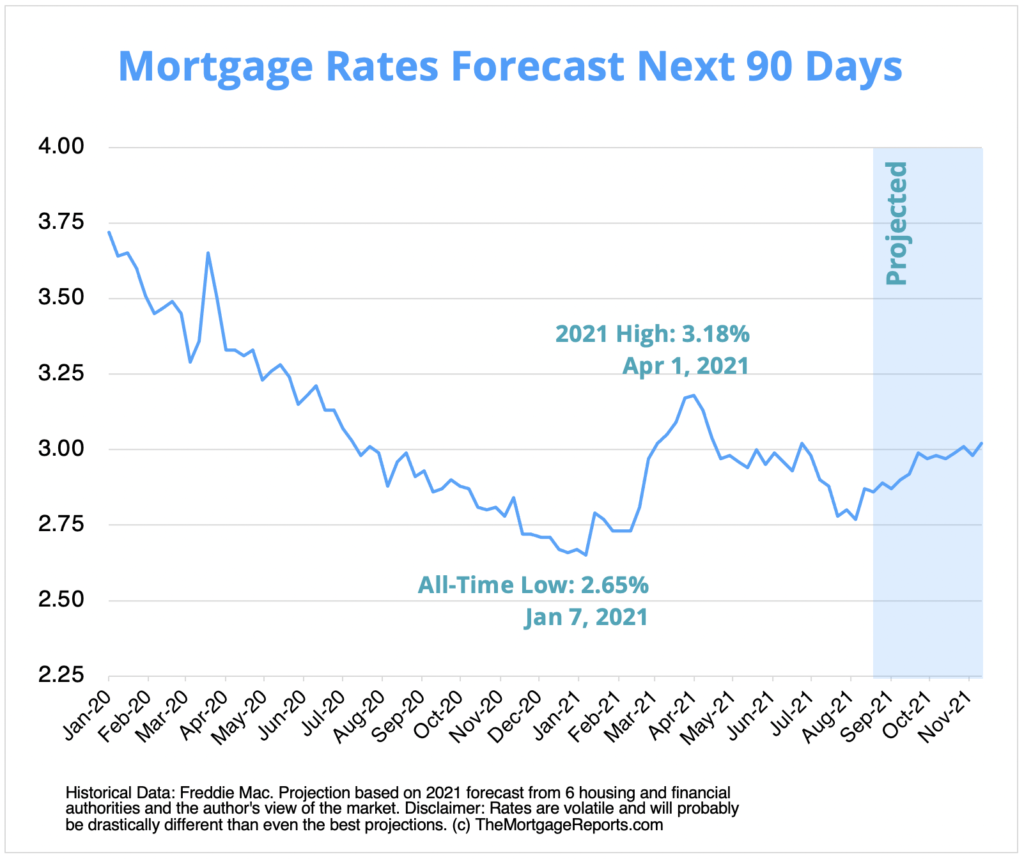

Typically, lenders inform borrowers to float when rates are steadily decreasing each day or week and will advise to lock-in a rate closer to the closing. However, according to The Mortgage Reports chart below, experts predict interest rates to rise in the next 90 days. With rates at historic lows, now is a great time to purchase or refinance your current mortgage, lock in a low rate, and take advantage of significant monthly savings!

At GuardHill, we will always make sure you are well informed throughout the mortgage and rate lock process. Contact us today to get started or learn more!