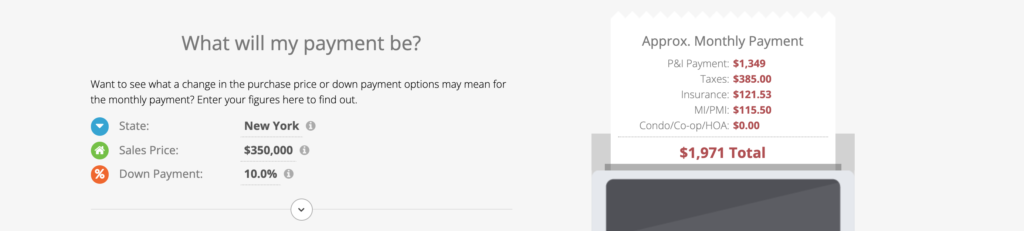

If you are thinking about buying a home or reviewing your current loan terms, you may be wondering what is included in your monthly mortgage payment. Your monthly payment will consist of the principal, interest, taxes, and insurance, and we break down each of the components below.

Principal

The mortgage principal refers to the actual amount of money (the loan) you borrowed from the mortgage company. This amount does not include interest or fees. The principal balance will decrease every time you make payments.

If you purchased a home for $100,000 and had a 20% down payment ($20,000), you would receive an $80,000 loan. Therefore, the mortgage principal is $80,000. As you continue to make monthly payments, the balance will slowly decrease.

Interest

Interest is the rate at which the mortgage company is charging you to borrow the principal. Interest rates will vary depending on the borrower’s credit profile and loan terms. No matter if you have a fixed-rate or adjustable-rate mortgage, interest will accrue annually.

To calculate how much interest you will pay each month, take the annual percentage rate (APR), and divide it by twelve. Then, take that number and multiply it by your principal balance. For example, let’s say your rate is 3.000%, and you have a remaining loan balance of $75,000. That means that you will pay approximately $187.50 in interest that month (3%/12) x 75,000 = $187.50.

The amount of interest you pay will continue to decrease as the principal decreases. Check out our mortgage amortization calculator to see how your monthly payments are allocated across these components over the life of the loan.

Taxes

Property taxes vary depending on the appraised value of your home and the neighborhood’s property tax rate. The appraised value of your home may be different from the market value or the amount you paid for the home. Both the appraised value and neighborhood property tax rate continuously change over time, so it’s important to stay up to date with those numbers by reviewing your local tax policy and estimated home value.

Check out this interactive tool to look at average tax rates on the local and state level. This is especially helpful if you wonder how taxes vary in different neighborhoods where you are house hunting.

Insurance

The most common types of insurance are homeowner’s and private mortgage insurance (PMI). Homeowner’s insurance protects a home from theft, fire, and other disasters and provides converge in case of damage from those events. All homeowners with a current mortgage balance are required to purchase homeowner’s insurance. The cost for this type of insurance may vary depending on your city and neighborhood; It may be more expensive for homes located in disaster-prone regions or high-crime areas.

Private mortgage insurance protects the mortgage company if you default on your loan and stop making monthly payments. This type of insurance is required if your down payment is less than 20% of the purchase price, or if you have a low credit score.

When is Your First Mortgage Payment Due?

Typically, your first mortgage payment will be due after the first full month following your mortgage closing. For example, if your loan closed on October 7th, your first full payment for the month of November would be due on December 1st. When you attend your closing, the settlement agent will review the payment details to make sure you are aware and prepared.