A mortgage note is a legal document signed by the borrower at the closing, promising to repay your mortgage. Mortgage notes are contractual documents filed with the local government that state the agreed-upon terms of your loan and outline the property’s details used to secure the mortgage

What is Outlined in a Mortgage Note?

The mortgage note specifies important factors related to your loan, such as:

- The total loan amount (the mortgage)

- The down payment amount

- Monthly or bi-monthly mortgage payments

- Loan program and term (30-year fixed-rate, 15-year fixed-rate, 10/1 ARM, 5/1 ARM, etc.)

- Pre-payment penalties (if applicable)

- Personal information such as the parties involved in the contract (you, the lender, etc.)

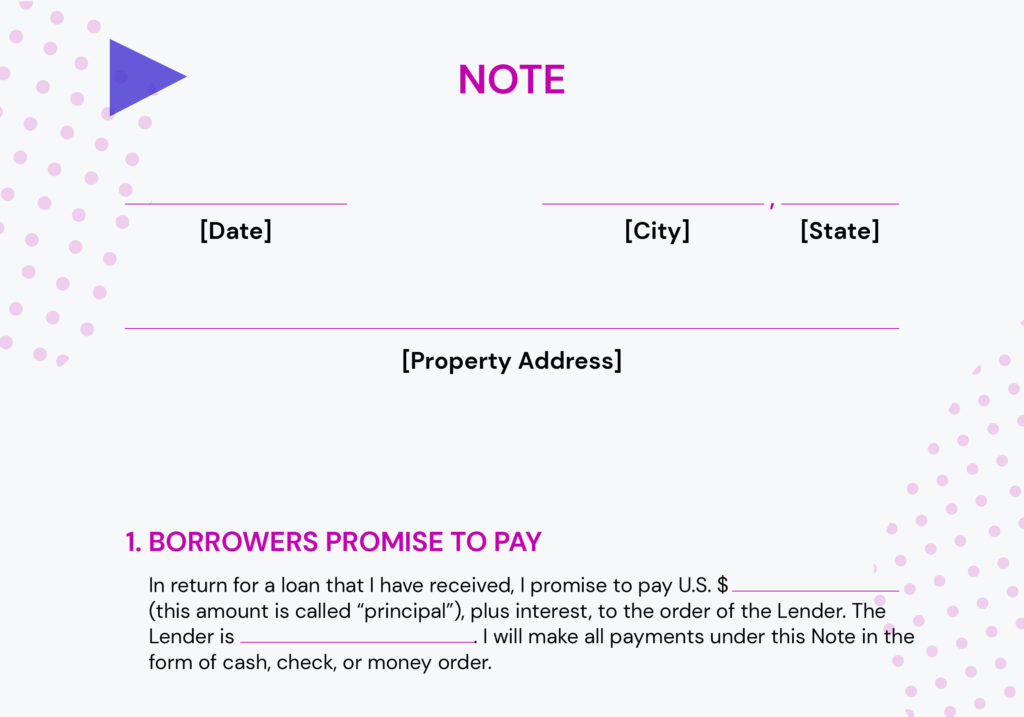

Mortgage Note Example

How to Obtain a Copy of Your Mortgage Note

You receive a copy of your mortgage note at your mortgage closing. It is essential to hold onto your mortgage note (and any other necessary paperwork received at closing), so you can refer to the original terms of your loan. If you happen to lose your closing papers or they get destroyed, you can obtain a new document through the county’s records. You may also contact the mortgage company that services your loan for a copy of the mortgage note.

Who Keeps the Original Mortgage Note?

At your mortgage closing, you will receive a copy of the mortgage note. Your mortgage company, or other financial institution, will hold onto the original version of the mortgage note. Mortgages are often bought and sold on the secondary market with the original note. Regardless of who owns your loan and which institution you are making payments to, you will receive the original note at the end of your loan once it is fully paid off.

What Happens if You Default on Your Mortgage?

If the terms of the mortgage outlined in the note are not met, then the lender has the right to begin foreclosure or repossess the property. Defaulting on your mortgage may negatively impact your credit score and your chances of getting future loans, such as personal or car loans.