If you are thinking about buying a home, you should consider how much money you will have for a down payment. A down payment is one of the highest up-front costs to purchasing a home. Many people, especially first-time homebuyers, rely on gift letters for a mortgage to help them purchase their dream home. We outline the rules and guidelines when using a gift letter for a mortgage down payment.

What is a Gift Letter?

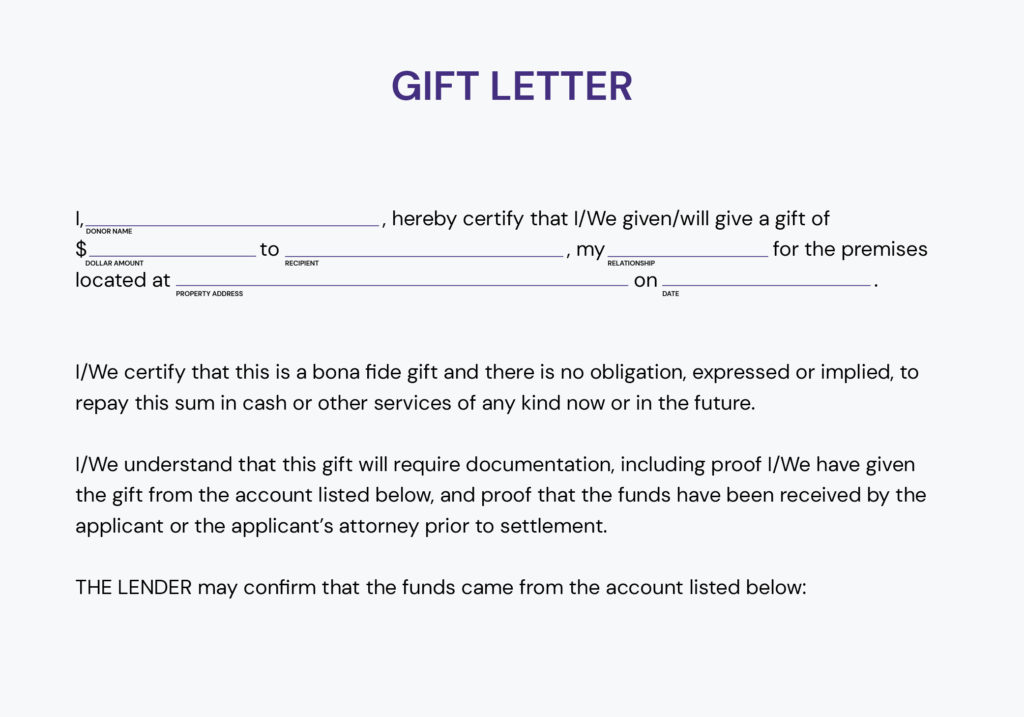

A down payment gift letter is a written statement signed by the borrower and donor that states the details and guidelines of the gift. The letter helps the mortgage company understand clearly that the funds are a gift, not a loan.

What Information will the Down Payment Gift Letter Include?

The gift letter will state the following information:

- Your name and the donor’s name

- The dollar amount of the gift

- Your relationship to the donor (i.e., daughter, cousin, friend)

- A statement explaining that the borrower will not repay the gift funds

- The property address

- A statement describing where the gift money comes from (an investment account, checking account, savings account, etc.)

- The donor’s signature

Sample Gift Letter

What are the Mortgage Down Payment Gift Rules?

When using a gift letter for a mortgage down payment, you must follow some rules and guidelines for the approval process to go smoothly.

- You must state your relationship to the donor

- The gift must come from a relative, godparent, or close friend. In contrast, some mortgage companies may only allow a down payment gift from blood relatives. The mortgage company must approve who is gifting the funds first before accepting the letter.

- The gift must come from a relative, godparent, or close friend. In contrast, some mortgage companies may only allow a down payment gift from blood relatives. The mortgage company must approve who is gifting the funds first before accepting the letter.

- You may not receive a gift from an interested party

- Anyone vested in the home, such as the seller, general contractor, or real estate agent, may not provide a down payment gift.

- Anyone vested in the home, such as the seller, general contractor, or real estate agent, may not provide a down payment gift.

- The gifted amount must be in line with the program guidelines

- The rules associated with a down payment gift may vary depending on the loan program, property type, and occupancy type. In most cases, you may receive a gift that covers the total cost of the down payment. For other programs, such as an investment property loan, you may only receive a gift up to a certain percentage of the down payment.

- You may not pay back the gifted funds

- One of the main points listed in a gift letter for a mortgage down payment states that the donor does not expect to receive any repayment for the gift.

- One of the main points listed in a gift letter for a mortgage down payment states that the donor does not expect to receive any repayment for the gift.

- Must be able to provide a paper trail and record of the funds

- The recipient and donor must provide statements showing where the gifted funds are coming from and going. The mortgage underwriter will re-review your bank accounts and statements throughout the mortgage process to ensure that all the gift funds are in line with the statements on the letter. Any potential discrepancies may require a letter of explanation.

What if I am Unable to Get a Gift Letter for a Mortgage?

If you want to buy a home but do not have any friends or family members who can provide a down payment gift, you should start focusing on creating a down payment savings plan. Building a concrete savings plan and timeline may help you reach your goal sooner and stay focused. Or, you may also explore some of our low down payment loan programs. Contact us to learn more about your financing options!