Mortgage interest rates remain at all-time lows, so now is an excellent time to consider refinancing. Maybe you never got around to refinancing during the pandemic, or perhaps you refinanced your mortgage in the last few years but have built up substantial equity in your home. Regardless, it’s crucial to regularly check up on your mortgage to ensure it aligns with your changing financial needs.

Here are a few reasons why you should consider refinancing your home right now:

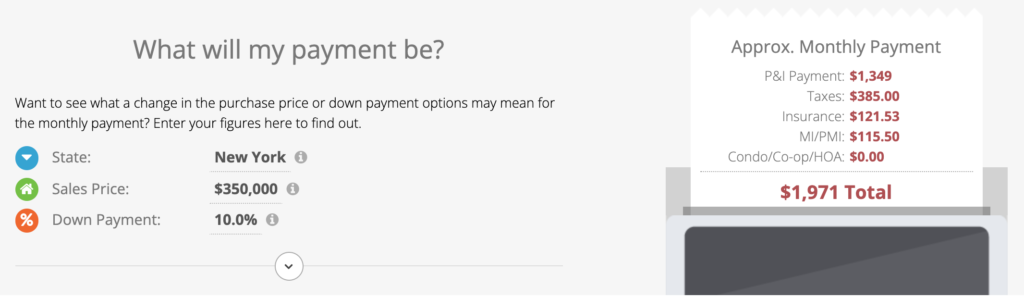

Lower your monthly mortgage payment

One of the most common reasons a homeowner refinances their mortgage is to lower their monthly mortgage payment. According to a recent Black Knight report, homeowners have more incentive to refinance now than before 2020. About 50% of homeowners who may benefit from a refinance right now have an interest rate greater than 3.5%.*

Click the image below to use an interactive monthly payment calculator to estimate how your monthly payment may change with a lower interest rate.

Take cash out of the equity of your home

Even if you refinanced 8, 12, or 24 months ago, you might still benefit from a refinance as the equity in your home has most likely increased. Equity is the difference between the market value of your home and the outstanding mortgage balance. Approximately $9.1 trillion In home equity remains untapped.* A cash-out refinance is an excellent option for those who can leverage their equity to pay for a down payment on a second home or investment property, cover the cost of renovations, or pay down high-interest-bearing debt.

Change the terms on your loan

Adjustable-rate mortgages (ARM) typically have lower interest rates than fixed-rate loans. If you plan to sell your home in the next few years, you may benefit from refinancing from a 30-year fixed to an ARM.

Cancel mortgage insurance premiums

If you originally had a down payment of less than 20%, you may have been required to pay mortgage insurance, often included in your monthly mortgage payment. If your home equity is greater than 20%, you may be able to refinance and cancel your mortgage insurance, which in turn will reduce your monthly payment.

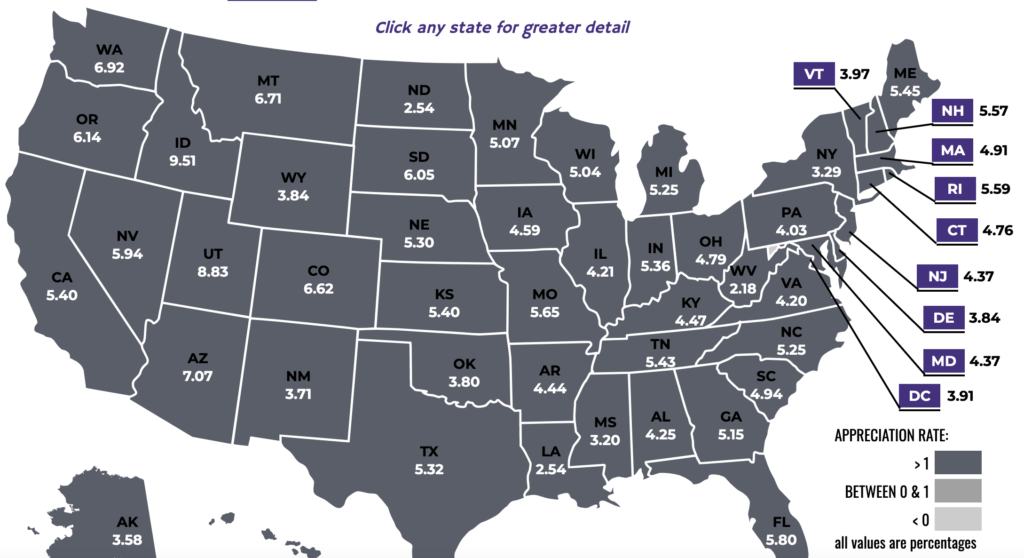

Home values are rising

Average property values are rising as demand for real estate remains strong. Rising property values provide homeowners with greater opportunities to benefit from a mortgage refinance. Use the interactive tool below to see what your home may be worth in today’s market.

If you are still wondering if refinancing will make sense for you and your financial needs, click here to read some common questions asked when refinancing. Get in touch with our mortgage specialists, who can evaluate your current scenario to see if you may benefit from a mortgage refinance.

*https://www.blackknightinc.com/black-knights-september-2021-mortgage-monitor/