What is a Debt-to-Income Ratio?

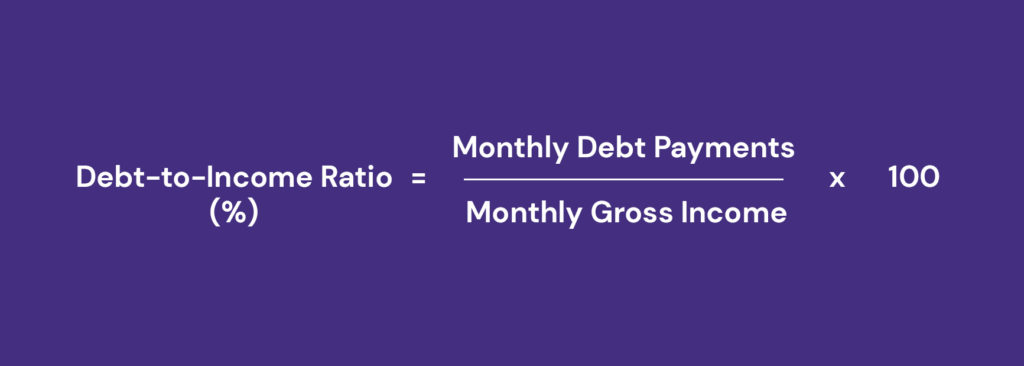

Your debt-to-income (DTI) ratio compares your monthly debt expenses to your monthly income. This evaluates how much debt you have and your ability to repay those debts with your current income stream.

How to Calculate your Debt-to-Income Ratio

To calculate your DTI ratio, you must add up all of your monthly debt obligations. This includes credit card payments, car loans, and housing expenses (rent or other mortgage payments). Then, you will divide your total monthly debt obligation by your monthly gross income, which is income earned before taxes and other deductions.

For example, let’s assume the following:

Monthly housing and debt expenses = $2,000

Monthly gross income = $6,000

DTI ratio = 33%

Why is Debt-to-Income Ratio Important for Mortgage Financing?

This ratio is a determining factor for loan qualification, as different programs may require different ratios. A mortgage lender will review your DTI ratio to determine how much more debt you may handle and ensure you will repay the loan.

- What is a good debt-to-income ratio?

The Consumer Financial Protection Bureau states that borrowers’ DTI ratios should not exceed 43% when applying for a mortgage. Typically, mortgage companies prefer to see borrowers with a DTI ratio of less than 36%.

Tips and Tricks to Lower your Debt-to-Income Ratio

If your ratio is higher than 43%, here are 5 helpful tips to help you meet your goal before applying for a mortgage!

1.) Increase your monthly debt payments

Try to cut back on unnecessary expenses and pay down a high-interest loan or credit card balance instead. These extra payments may seem minor at the moment, but any additional payment positively affects your DTI ratio.

2.) Pay off a loan completely before applying for a mortgage

If you are close to paying off a debt in full, like a car payment, it may be beneficial to wait to apply for a mortgage until you finish paying off that loan.

3.) Postpone large purchases

Avoid making large purchases before or during the mortgage process. We recommend waiting until after closing to purchase expensive furniture or a new car.

4.) Review your debt-to-income ratio monthly

While you are focusing on lowering your ratio, we recommend checking in every month to see how much it has decreased. It may be a great motivator and help you keep working towards your goals!

5.) Create a strategy and a long-term goal for yourself

Improving your debt-to-income ratio may take some time. It’s helpful to create a strategy for yourself, such as the “avalanche” or “snowball” strategy, to help you stay focused and on track. The “avalanche” strategy focuses on paying off your debts with the highest interest rates. On the contrary, the “snowball” strategy focuses on paying off your smallest debt first and then moving on to the next debt.

If you’re interested in lowering your DTI, get in touch with one of our mortgage specialists to see how they can help you by reducing your DTI ratio.